All Categories

Featured

Table of Contents

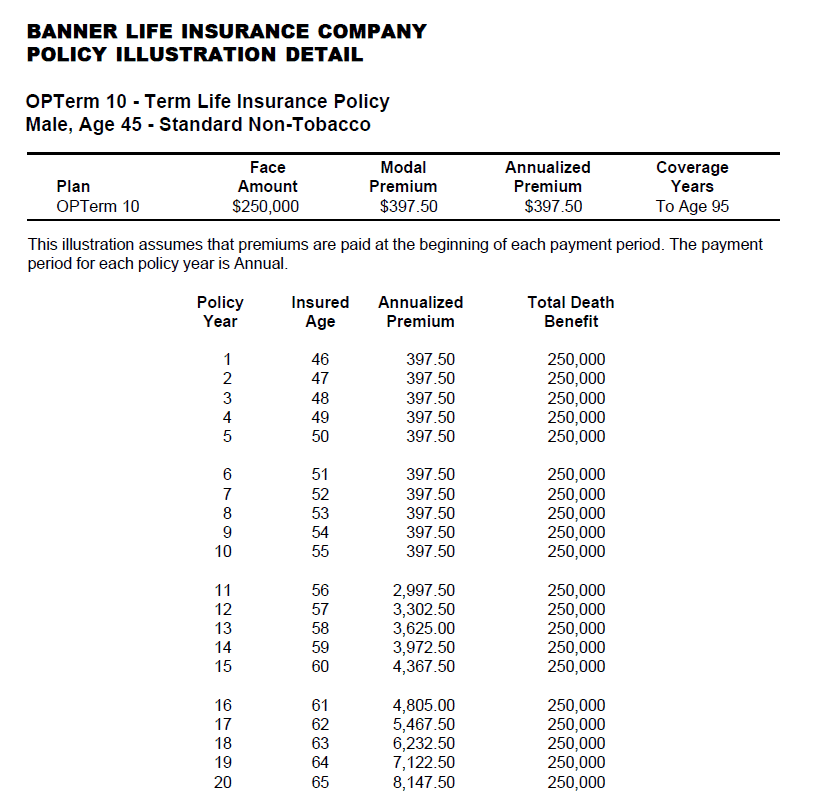

A level term life insurance policy policy can provide you satisfaction that the people who depend on you will certainly have a survivor benefit during the years that you are planning to support them. It's a method to help look after them in the future, today. A degree term life insurance policy (often called degree premium term life insurance coverage) plan gives coverage for a set number of years (e.g., 10 or twenty years) while maintaining the premium payments the exact same for the period of the policy.

With level term insurance, the cost of the insurance will stay the same (or possibly decrease if returns are paid) over the term of your plan, generally 10 or twenty years. Unlike permanent life insurance policy, which never ever runs out as lengthy as you pay costs, a degree term life insurance plan will certainly end at some factor in the future, typically at the end of the period of your level term.

Why Term Life Insurance For Seniors Matters

As a result of this, lots of people use permanent insurance policy as a stable economic planning tool that can serve numerous needs. You may be able to convert some, or all, of your term insurance during a collection period, normally the very first ten years of your plan, without requiring to re-qualify for protection even if your health and wellness has changed.

As it does, you might intend to include to your insurance protection in the future. When you first get insurance coverage, you may have little cost savings and a big mortgage. Eventually, your cost savings will certainly expand and your home loan will certainly diminish. As this occurs, you may wish to eventually reduce your survivor benefit or think about converting your term insurance policy to an irreversible plan.

Long as you pay your premiums, you can rest easy recognizing that your loved ones will certainly get a death benefit if you pass away during the term. Lots of term policies allow you the capability to convert to long-term insurance coverage without having to take one more health and wellness exam. This can enable you to benefit from the fringe benefits of a permanent plan.

Level term life insurance policy is one of the easiest paths right into life insurance coverage, we'll go over the advantages and drawbacks to make sure that you can pick a strategy to fit your demands. Degree term life insurance coverage is one of the most usual and fundamental kind of term life. When you're trying to find short-lived life insurance coverage plans, degree term life insurance policy is one route that you can go.

You'll fill out an application that consists of general individual info such as your name, age, and so on as well as a much more in-depth questionnaire about your clinical background.

The short answer is no., for instance, allow you have the convenience of fatality benefits and can build up cash money worth over time, indicating you'll have extra control over your advantages while you're to life.

What is Term Life Insurance For Couples? Discover the Facts?

Motorcyclists are optional stipulations added to your plan that can offer you extra benefits and defenses. Anything can take place over the program of your life insurance policy term, and you desire to be ready for anything.

This biker gives term life insurance policy on your children through the ages of 18-25. There are circumstances where these benefits are constructed into your plan, however they can likewise be readily available as a different addition that needs extra payment. This rider offers an added survivor benefit to your beneficiary needs to you die as the outcome of an accident.

Latest Posts

Guaranteed Acceptance Burial Insurance

Funeral Insurance Rate

Final Expense Life Insurance Carriers