All Categories

Featured

Table of Contents

Term Life Insurance Policy is a sort of life insurance plan that covers the insurance policy holder for a certain amount of time, which is referred to as the term. The term sizes vary according to what the specific selects. Terms normally range from 10 to 30 years and rise in 5-year increments, providing level term insurance policy.

They generally give a quantity of protection for a lot less than irreversible types of life insurance policy. Like any type of plan, term life insurance policy has benefits and disadvantages depending on what will certainly work best for you. The advantages of term life consist of price and the capacity to customize your term size and protection quantity based upon your demands.

Depending on the kind of plan, term life can use taken care of costs for the whole term or life insurance coverage on degree terms. The death advantages can be repaired.

You should consult your tax consultants for your details valid situation. *** Fees show policies in the Preferred And also Price Course problems by American General 5 Stars My representative was very well-informed and helpful while doing so. No pressure to purchase and the process fasted. July 13, 2023 5 Stars I was satisfied that all my needs were fulfilled without delay and expertly by all the representatives I spoke to.

Why Term Life Insurance For Spouse Is an Essential Choice?

All documents was electronically completed with accessibility to downloading for personal data maintenance. June 19, 2023 The endorsements/testimonials provided ought to not be taken as a referral to purchase, or a sign of the value of any kind of product or solution. The endorsements are real Corebridge Direct customers who are not associated with Corebridge Direct and were not given compensation.

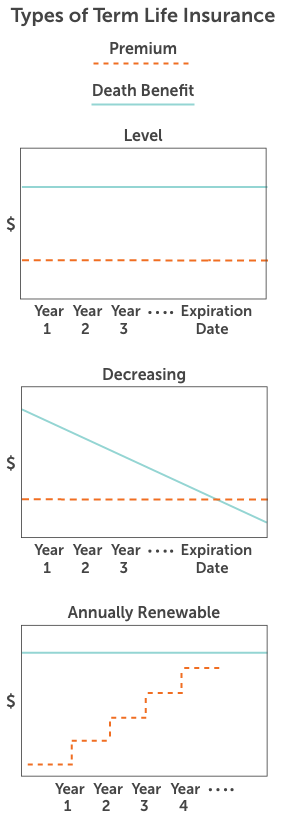

There are several sorts of term life insurance policy policies. As opposed to covering you for your entire life-span like whole life or universal life policies, term life insurance policy only covers you for a marked amount of time. Plan terms typically vary from 10 to 30 years, although much shorter and longer terms might be offered.

Most typically, the policy ends. If you want to keep protection, a life insurance provider might use you the alternative to restore the plan for an additional term. Or, your insurance company might allow you to convert your term plan to a long-term policy. If you added a return of costs rider to your policy, you would certainly get some or every one of the money you paid in costs if you have actually outlived your term.

Level term life insurance might be the finest option for those that desire protection for a set amount of time and desire their premiums to remain steady over the term. This might put on shoppers worried concerning the price of life insurance and those who do not intend to change their survivor benefit.

That is since term policies are not guaranteed to pay, while irreversible policies are, supplied all premiums are paid. Level term life insurance coverage is generally a lot more pricey than reducing term life insurance policy, where the fatality advantage decreases with time. In addition to the kind of policy you have, there are several other factors that aid determine the price of life insurance: Older candidates typically have a greater death threat, so they are typically extra costly to insure.

On the other hand, you may have the ability to secure a less costly life insurance price if you open up the plan when you're more youthful. Similar to innovative age, bad wellness can also make you a riskier (and extra costly) candidate permanently insurance coverage. However, if the condition is well-managed, you might still be able to find affordable insurance coverage.

What is Level Premium Term Life Insurance Policies? A Beginner's Guide

Health and age are generally much more impactful costs factors than gender., may lead you to pay more for life insurance coverage. High-risk jobs, like home window cleaning or tree trimming, may additionally drive up your cost of life insurance.

The very first action is to establish what you require the plan for and what your spending plan is. Some companies offer online pricing estimate for life insurance, but numerous need you to contact an agent over the phone or in person.

1Term life insurance policy provides short-lived defense for a critical duration of time and is usually less pricey than permanent life insurance policy. 2Term conversion guidelines and constraints, such as timing, might use; for instance, there may be a ten-year conversion opportunity for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance policy Purchase Alternative in New York City. 4Not readily available in every state. There is a cost to exercise this rider. Products and motorcyclists are available in approved jurisdictions and names and functions may differ. 5Dividends are not ensured. Not all participating policy owners are eligible for dividends. For choose motorcyclists, the problem puts on the insured.

Our term life alternatives include 10, 15, 20, 25, 30, 35, and 40-year policies. The most popular type is level term, meaning your settlement (premium) and payout (survivor benefit) remains degree, or the same, until the end of the term period. Term life insurance with level premiums. This is one of the most straightforward of life insurance alternatives and calls for extremely little maintenance for plan owners

You might provide 50% to your partner and divided the rest amongst your grownup kids, a moms and dad, a close friend, or also a charity. * In some instances the survivor benefit may not be tax-free, find out when life insurance coverage is taxed.

What is Decreasing Term Life Insurance? Comprehensive Guide

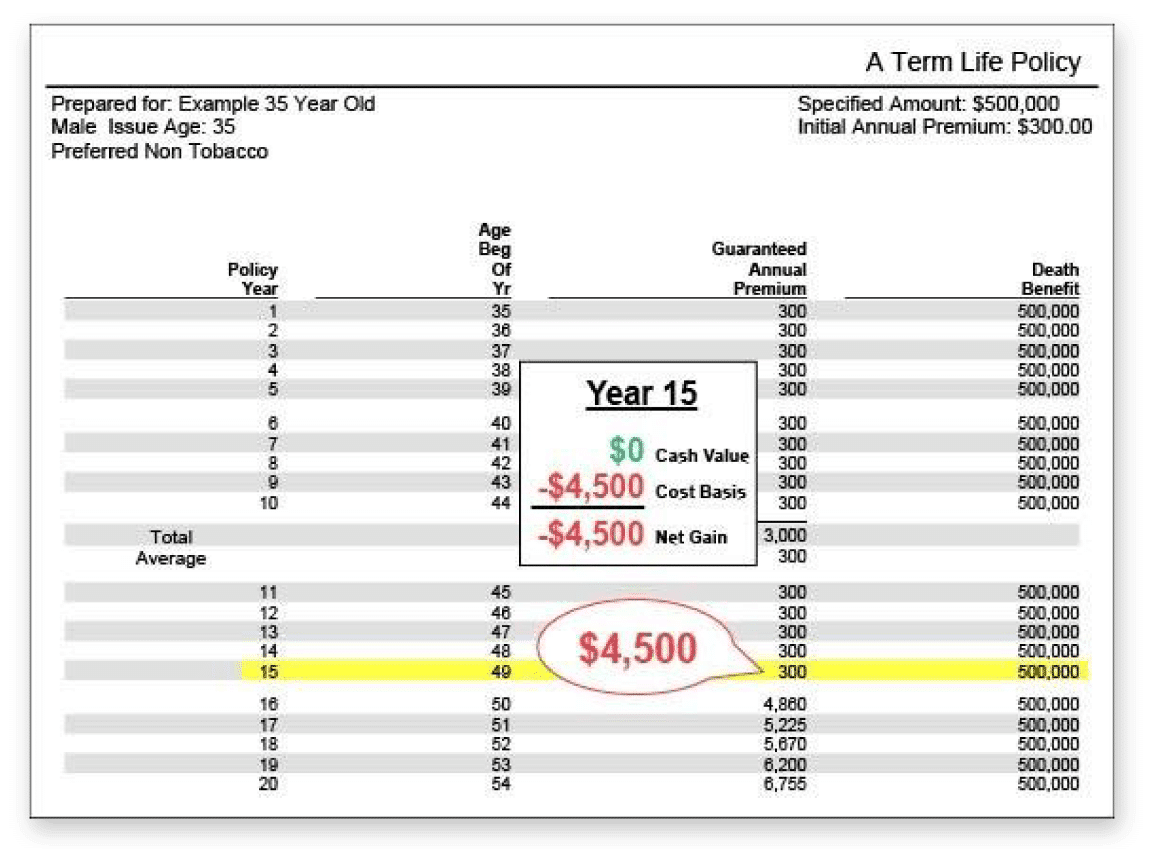

There is no payout if the plan runs out prior to your fatality or you live past the policy term. You might have the ability to renew a term policy at expiry, however the costs will certainly be recalculated based upon your age at the time of renewal. Term life insurance policy is typically the least pricey life insurance policy offered since it uses a death advantage for a restricted time and doesn't have a cash money worth part like irreversible insurance coverage - Term life insurance with level premiums.

At age 50, the costs would certainly increase to $67 a month. Term Life Insurance coverage Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and women in excellent health.

Passion prices, the financials of the insurance company, and state guidelines can additionally affect premiums. When you take into consideration the quantity of coverage you can get for your costs dollars, term life insurance tends to be the least costly life insurance.

Latest Posts

Funeral Insurance Rate

Final Expense Life Insurance Carriers

Instant Life Insurance Reviews